News & Analysis

-

-

Regulation & Reporting

Industry steps up calls for improved sustainability disclosure regime

UKSIF, PRI and IIGCC have called on governments and regulators to lay out clearer reporting and disclosure standards

-

News

Nordea AM makes double hire to sustainable thematic team

Two new portfolio managers bring team up to 15 professionals

-

Climate & Planet

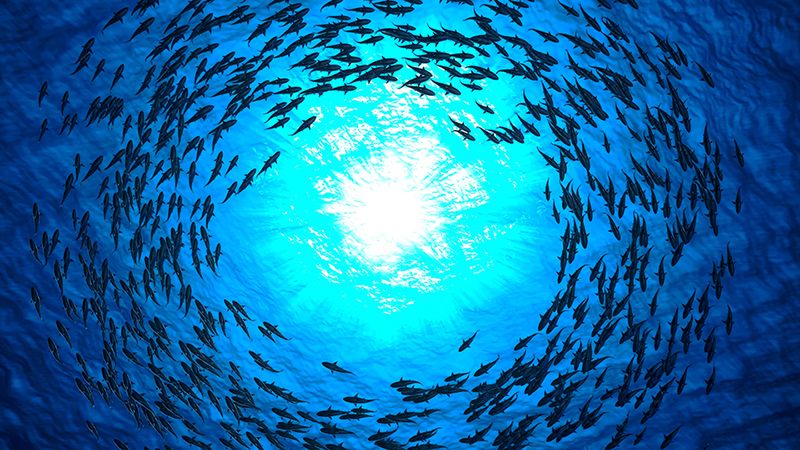

Bridging the adaptation gap

Pietro Sette looks at green bond allocations to the adaptation projects – and explains why water infrastructure will help close the gap

-

Opinion

Right time, right place: Why now is the moment for British pension funds to invest in Britain

Place-based impact investment is about more than money flows, writes Mark Hepworth

-

News

Ex-Invesco sustainable investing head launches EMs business

Investment platform T50 will bridge the gap between emerging markets financial institutions and global capital

-

Regulation & Reporting

AIC calls on government to review inflation indexation in renewables scheme amid £346m losses

Several companies hit following the announcement

-

Research (EU)

Asset managers failing to address climate risk can ‘expect to lose clients’

Most seem willing to turn a blind eye to fiduciary duty, finds Reclaim Finance research

-

Opinion

Sustainable investing has grown up: Are your portfolios keeping pace?

Advisers need to ensure portfolios are fit for purpose, writes Parmenion’s Shri Krishnansen

-

News

Aegon AM’s Beacham becomes chair of IA Stewardship Committee

Former Artemis CIO Paras Anand was previous chair

-

Interviews

Q&A with BlackRock’s Kaminker: ‘Growing appetite for affordable energy is creating opportunities for renewables’

BlackRock’s head of sustainable investment research looks at how renewables are increasing their share of the global power mix

-

News & Analysis

Osmosis adds emerging markets transition fund

The result of a three-year research project into EM data on carbon, water and waste

-

Opinion

For better or worse, COP30 changed little for investors

The proceedings offered a few pointers of note for investors, writes MSCI’s Linda-Eling Lee

-

PA Future Committee

Critical minerals: The cornerstone of a just transition

How can we ensure mining delivers a transition that is not only green but also just?

-

Opinion

COP30 may have burned out, but local leaders sparked hope for the future

SDCL’s Lolita Jackson reports back from a positive Local Leaders Summit, also held in Brazil

Data

-

Regulation & Reporting

Industry steps up calls for improved sustainability disclosure regime

UKSIF, PRI and IIGCC have called on governments and regulators to lay out clearer reporting and disclosure standards

-

News & Analysis

Osmosis adds emerging markets transition fund

The result of a three-year research project into EM data on carbon, water and waste

-

Analysis

Industry diversity shows little improvements but firms step up on data collection

Investment Association and PwC has jointly published the third annual Talent Report

-

Analysis

GISA reports 50% increase in funds adopting sustainable investment approach over past two years

Adoption of sustainable investment approach ‘striking’ as it increases by $5.5trn since 2023

-

Opinion

Turning fragmented data into strategic advantage for asset managers

Data governance should sit at the heart of any operational strategy, writes Gresham’s Jenn McMackin

-

Opinion

Europe’s sustainable finance crossroads: Will SFDR 2.0 close the transparency gap?

PwC’s sustainability leaders looks at where PAI disclosures can improve and why SFDR needs to be right this time round

Climate & Planet

-

Opinion

For better or worse, COP30 changed little for investors

The proceedings offered a few pointers of note for investors, writes MSCI’s Linda-Eling Lee

-

Analysis

COP30 outcome: A ‘moral failure’ or realistic in current geopolitical climate?

Despite high hopes, many are frustrated COP30 ‘barely moved the dial’ on ending fossil fuel dependency

-

Opinion

Ignore the gloom: Why COP30 was a success

Coverage of the summit focused too heavily on what was missing

-

PA Future Committee

Investors must not back down on climate action

It is no longer fashionable to speak out on climate, writes EdenTree’s Carlota Esguevillas

-

Interviews

Climate Bonds Initiative: ‘Integrity remains the number one concern for investors’

Sean Kidney explains why certification, robust data and transparent methodologies matter

-

News & Analysis

Green Dream with Storebrand’s Ripman: Sustainable investing appears to be turning a corner

Manager of the Global Solutions fund discusses investing in equal opportunities and how climate change is becoming more front of mind for investors

PA Future Committee

-

PA Future Committee

Conflict minerals and investor engagement

Castlefield’s Ita McMahon on why investors can’t expect instant resolutions

-

PA Future Committee

Critical minerals: The cornerstone of a just transition

How can we ensure mining delivers a transition that is not only green but also just?

-

PA Future Committee

The ethics of AI

Liontrust’s Peter Michaelis explores how to balance opportunity and risk

-

PA Future Committee

Investors must not back down on climate action

It is no longer fashionable to speak out on climate, writes EdenTree’s Carlota Esguevillas

-

Opinion

Engagement is essential as chip influence intensifies

Demand for these notoriously resource-intensive components is on the rise

-

PA Future Committee

Extreme weather: A wake-up call for stronger strategic planning

UKSIF CEO says businesses recognise the value of transition plans but wants clarity on government plans